¶ Financial Institution Accounts

¶ General Information

Financial Institution Accounts represent clients authorized bank accounts from which financial data can be retrieved.

They are authorized by administrators. Each bank has its authorization process defined. In most cases, there is some multi-factor authentication, where users verify their identity.

¶ Financial Institution Accounts Overview

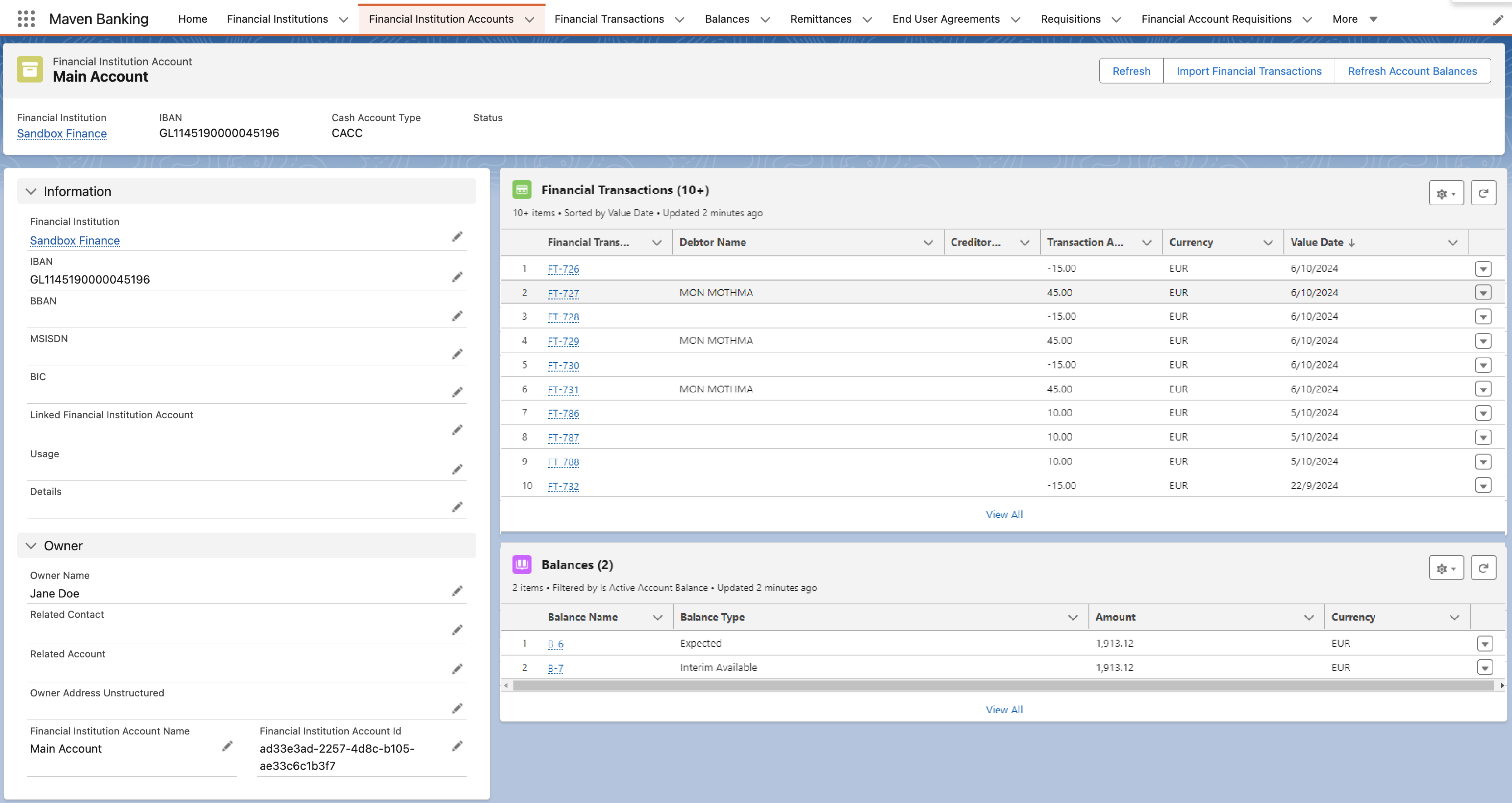

Maven Banking users can find these bank accounts under the Financial Institution Accounts tab, where they can perform the following actions:

- Refresh Account Details.

- Import Financial Transactions.

- Refresh Account Balances.

Refreshing Account Details is exclusive to Maven Banking Administrators

Each Financial Institution Account record provides a full overview of account details.

You can also find Financial Transactions and Balances related lists on the record's layout. They show information on retrieved financial transactions and balances of the respective account.

Financial transactions and Balances are sorted by the booking date. The latest transactions are displayed at the top.

All that enables an overview of the current account state and gives access to any specific transaction for further examination.

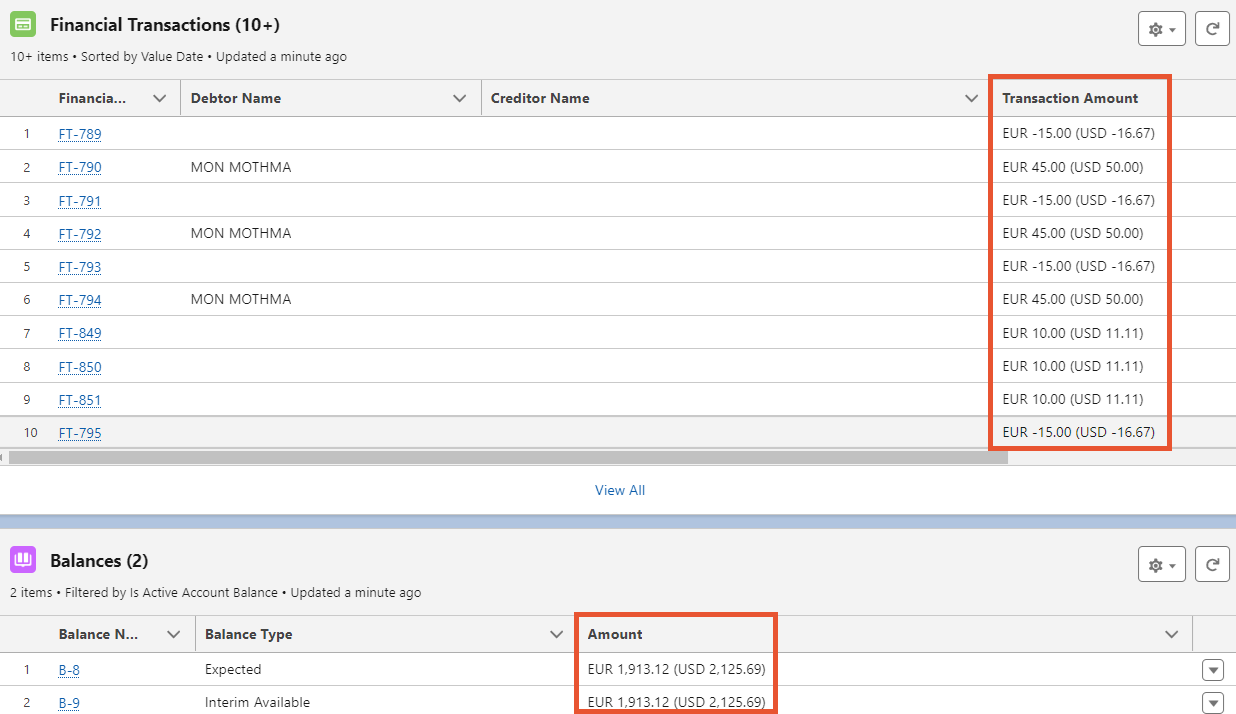

If you have Multiple Currencies activated on your Org, the layout of the Financial Transactions and Balances related lists would differ from the Single Currency Org. In the screenshot below you can see the difference:

- There is no Currency column.

- The Transaction Amount column holds the value in the transaction currency and the calculated amount in the corporate currency.

¶ Refresh Account Details

As mentioned above, administrators have the exclusive right to refresh bank account details. This action pulls all the latest changes to the account from the related financial institution.

Account details refresh can lead to loss of data so it needs to be done with caution. The administrator can back up the current account details before refresh.

Financial Institution Account can be easily connected to Salesforce standard Account and Contact records by populating the Related Account and Related Contact fields in the Owner section.

This can be done manually or with a simple automation Flow based on custom conditions.

¶ Import Financial Transaction

Importing financial transactions is the number one feature of Maven Banking. This action is available for both administrators and standard users.

Initial transactions import retrieves all transactions from the date calculated by Max. Historical Days up to current date. Any additional import retrieves only new transactions.

Initial import should be done from the financial institution account record detail page as it can handle importing records in bulk processing.

Users don't need to worry about duplicates or missing out on transactions, as the system handles those.

There could be situations when you would like to delete some transaction records and get them later again with another import. But it may be problematic in some scenarios. Let us explain the retrieving process so you get an idea of what we are talking about.

With each new import, we retrieve only new transactions. It means, that the retrieval starts from the date of the latest Financial Transaction record you have on the respective Financial Institution Account.

Let's say, today is September 1st, 2024. On the authorized Financial Institution Account in Maven Banking, you have the following Financial Transactions imported:

- June 23rd, 2024.

- August 6th, 2024.

- August 19th, 2024.

In that case, the "starting date" for the retrieval is August 19th 2024. If you need to delete the transaction from that date and import it, you can without issues. But if you would like to delete and get back any transaction before August 19th, 2024, it won't be brought back. The process finds the the latest transaction record on the authorized account and imports everything after it, but not before.

You can schedule the import of new transactions to run automatically for the selected accounts. Administrators can specify such import parameters as retrieval frequency, start & end time, and the skip weekends option in the Business Hours Settings. It enables various automation Flows to be built around financial transactions in a pretty straightforward way.

Learn more about it in Financial Transactions page.

¶ Refresh Account Balances

Both administrators and standard users can retrieve or refresh account balances.

The important thing to emphasize is that we are referring to Account Balances. A more detailed explanation is on the Balances page.

¶ Available Fields

| Field API Name | Values/Type | Description | Required |

|---|---|---|---|

BBAN__c |

Text |

Financial Institution Account BBAN. | false |

BIC__c |

Text |

Financial Institution Account BIC. | false |

Cash_Account |

Picklist |

ExternalCashAccount Type1Code from ISO 20022. | false |

Details__c |

Text |

Specifications that might be provided by the financial institution - characteristics of the account - characteristics of the relevant card. | false |

Financial |

Lookup |

Financial Institution. | false |

Financial |

Text |

Financial Institution Account ID. | true |

IBAN__c |

Text |

Financial Institution Account IBAN. | false |

Linked_Financial |

Lookup |

Optional cash account associated to pending card transactions. | false |

MSISDN__c |

Text |

An alias to a payment account via a registered mobile phone number. | false |

Owner_Address |

Text |

Address of the legal account owner. | false |

Owner_Name__c |

Text |

Name of the legal account owner. If there is more than one owner, then e.g. two names might be noted here. For a corporate account, the corporate name is used for this attribute. | false |

Related_Account__c |

Lookup |

Related Salesforce Account. | false |

Related_Contact__c |

Lookup |

Related Salesforce Contact. | false |

Status__c |

Picklist |

Account status. The value is one of the following: "enabled": account is available; "deleted": account is terminated; "blocked": account is blocked; e.g. for legal reasons If this field is not used, then the account is available in the sense of this specification. | false |

Usage__c |

Picklist |

Specifies the usage of the account (PRIV: private personal account & ORGA: professional account). | false |