¶ Financial Transactions

¶ General Information

The importance of financial transactions data lies in its ability to provide critical insights into a business's economic health and operational efficiency. Accurate, continuous, and up-to-date financial data ensures that companies can make informed decisions, manage cash flow effectively, and maintain regulatory compliance.

Robust financial transactions data supports strategic planning, operational efficiency, and financial stability.

Maven Banking offers access to account data from up to 24 months in the past (historical transactions) and up to 180 days of continuous access.

Financial institutions can have their limits on the number of validity days and days from which you can get financial transactions.

For example, some Banks allow only 90 or fewer days of transaction history.

¶ Financial Transactions Overview

Financial Transactions in Maven Banking can be retrieved in two ways:

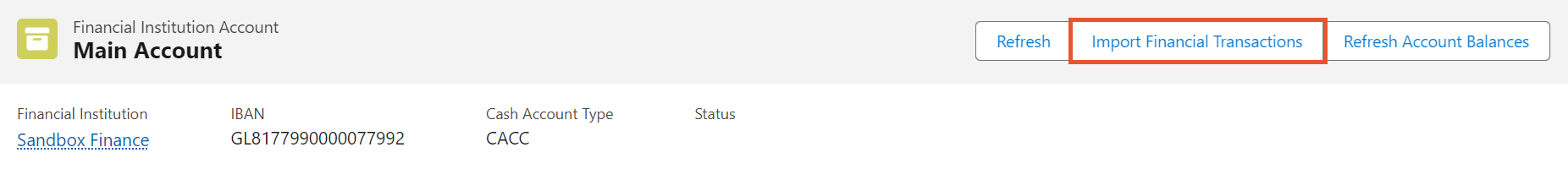

- Manually through the Financial Institution Account record page.

- Scheduled retrieval for selected Financial Institution Accounts.

Initial retrieval for each Financial Institution Account should be done manually.

You can import transactions manually on the respective Financial Institution Account record. Click the Import Financial Transactions button and finish the import.

Instructions on how to set the scheduled retrieval are in the separate section below.

Financial Transactions data is heavily dependent on financial institutions of related financial institution accounts. This means the bank defines which data is contained in the response we get.

That is why financial transactions from one financial institution can contain only basic info like amount, currency & value date. Others can have data like debtor account, remittance information, balance after transaction, etc.

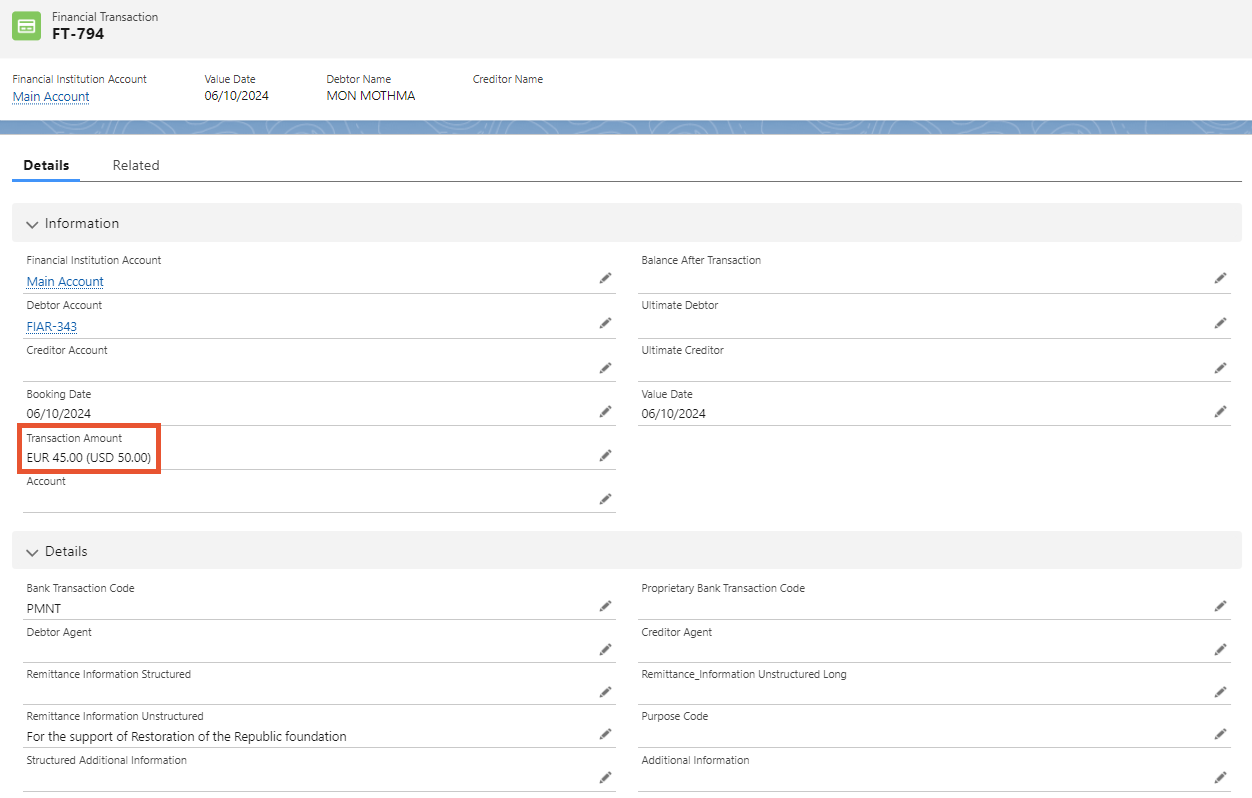

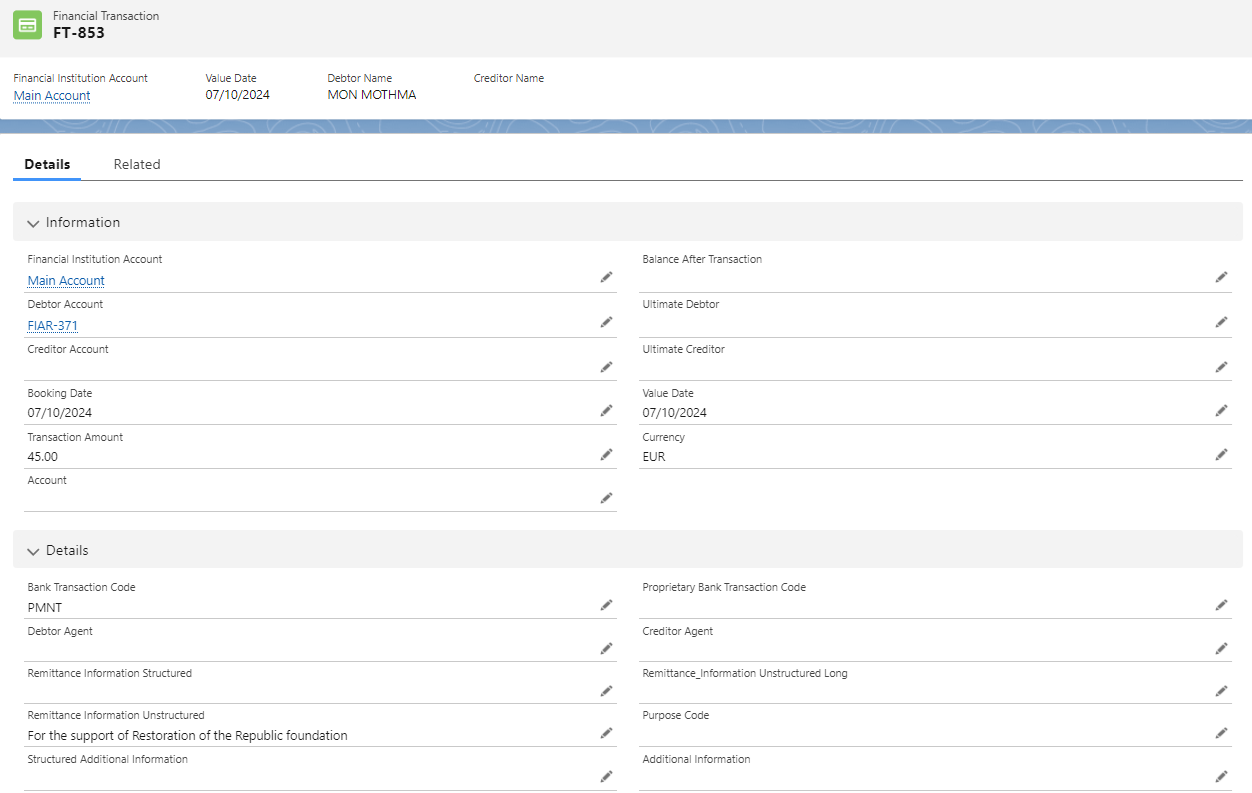

If you have Multiple Currencies activated on your Org, the layout of the Financial Transaction record would differ from the Single Currency Org. In the screenshot below you can see the difference:

- There is no Currency field.

- The Amount field holds the value in the transaction currency and the calculated amount in the corporate currency.

¶ Scheduled Retrieval

The administrator can set up the scheduled retrieval for you. Manual retrieval is available for administrators and standard users if accounts are successfully authorized.

Available scheduled retrieval parameters are:

- Frequency (in minutes). Controls how often financial transactions are retrieved.

- Start Hour. Controls retrievals start hour for each day.

- End Hour. Controls retrievals end hour for each day.

- Skip Weekends. Option to pause the retrieval during the weekend/

Let's say the following parameters are defined:

- Frequency: 30.

- Start Hour: 9.

- End Hour: 17.

- Skip Weekends: true.

This would mean financial transactions are retrieved every 30 minutes, from Monday to Friday, during the firm's business hours, which are 9-17h. With this setup, if there were any transactions during the weekend they would be retrieved on Monday morning.

¶ Currency Exchange

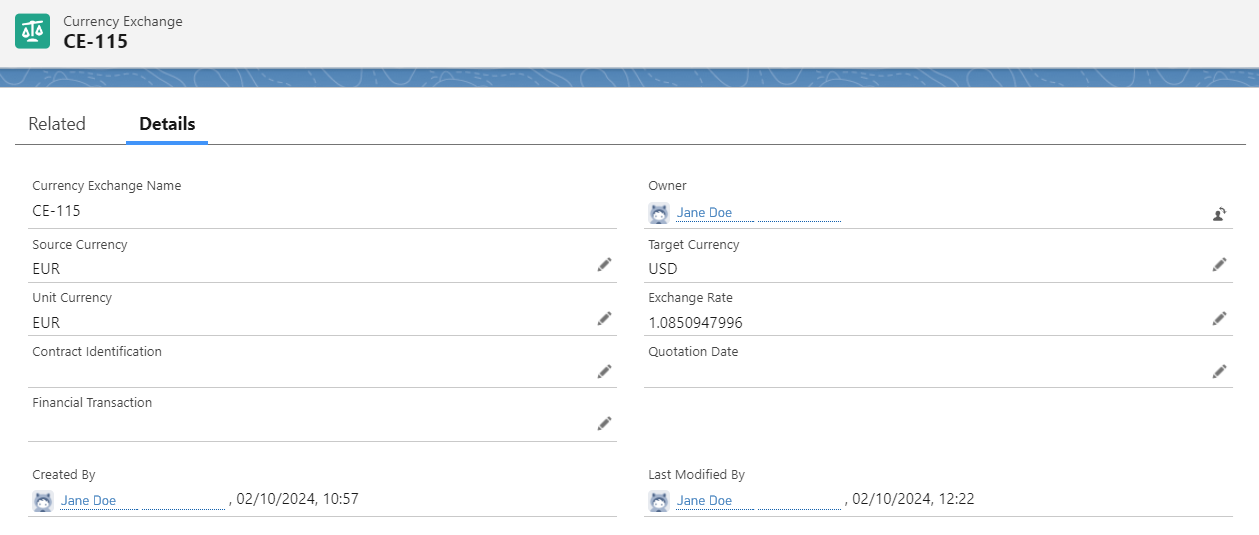

You may've noticed the Related tab on the Financial Transaction record. This tab holds data about the currency exchange operations that run with the respective financial transaction.

Let's say, the financial institution account's currency is the Euro, but the transaction was in US Dollars. The corresponding Currency Exchange record is created and connected to the Financial Transaction record. The record holds source and target currencies, and the used exchange rate.

¶ Available Fields

| Field API Name | Values/Type | Description | Required |

|---|---|---|---|

Additional |

Text |

Might be used by the financial institution to transport additional transaction-related information. | false |

Balance_After |

Lookup |

Represents balance after specific transaction. | false |

Bank_Transaction |

Picklist |

Bank transaction code as used by the financial institution and using the sub-elements of this structured code defined by ISO20022. | false |

Booking_Date__c |

Date |

Date when an entry is posted to an account on the financial institution's books. | false |

Creditor_Account__c |

Lookup |

Related Financial Institution Account Reference. | false |

Creditor_Agent__c |

Text |

Creditor Agent BICFI Code. | false |

Creditor_Name__c |

Text |

Name of the creditor if a "Debited" transaction. | false |

Currency__c |

Picklist |

Three-letter alphabetic code representing transaction currency (ISO 4217). | false |

Debtor_Agent__c |

Text |

Creditor Agent BICFI Code. | false |

Debtor_Account__c |

Lookup |

Related Financial Institution Account Reference. | false |

Debtor_Name__c |

Text |

Name of the debtor if a "Credited" transaction. | false |

Financial |

Lookup |

Related Financial Institution Account. | false |

Proprietary_Bank |

Text |

Proprietary bank transaction code as used within a community or a financial institution. | false |

Purpose_Code__c |

Picklist |

Alphanumeric code indicating the nature and purpose of the fund transfer. | false |

Remittance |

Text |

Reference as contained in the structured remittance reference structure. | false |

Remittance |

Text |

Reference as contained in the unstructured remittance reference structure. | false |

Remittance |

Long Text Area |

||

Structured |

Lookup |

Related Structured Additional Information. | false |

Transaction |

Currency |

The amount of the transaction as billed to the account. | false |

Transaction_Id__c |

Text |

Unique transaction identifier given by financial institution. | false |

Ultimate |

Text |

Represents a final party who is ultimately entitled to receive payment on a debt. | false |

Ultimate |

Text |

Represents a final party who is ultimately responsible for repaying a debt. | false |

Value_Date__c |

Date |

The Date at which assets become available to the account owner in case of a credit. | false |